The CME FedWatch Tool, which predicts rate moves based on expectations of futures traders, puts the odds of a 25 basis-point cut in September at 94.2%.

The much-awaited Federal Reserve’s rate-setting meeting is upon us, and the record levels of the market suggest that the market has baked in expectations of at least a 25-basis-point cut at the meeting.

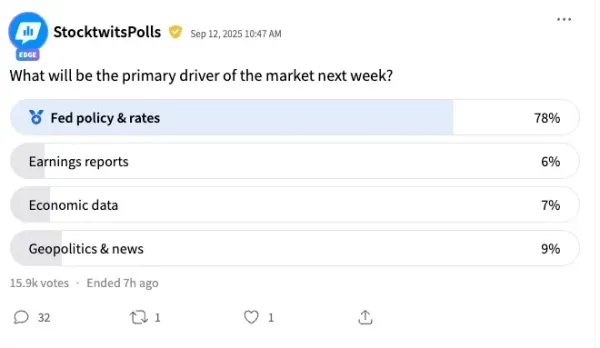

Therefore, it comes as no surprise that retail users of the Stocktwits platform picked the meeting as the primary driver of the market this week.

Poll results, based on responses from nearly 16,000 users, show that 78% of the responders see the Fed policy and interest rates as the “primary driver” of the market this week. Nine percent picked geopolitical news, 6% chose earnings, and 7% saw economic data as the top catalyst.

The Fed’s monetary policy-setting arm, the Federal Open Market Committee (FOMC), will meet on Tuesday to deliberate the central bank’s monetary policy stance. The post-meeting policy statement, scheduled for release at 2 p.m. ET on Wednesday, will be accompanied by the “Summary of Economic Projections” (SEP), which comprises the updated economic projections and the dot-plot curve.Chair Jerome Powell will also explain the central bank’s rationale at a press conference that follows.

Factoring in a rate cut, all the major averages rallied to record highs last week (Thursday) before the S&P 500 Index and the Dow Jones Industrial Average pulled back slightly on Friday.

The SPDR S&P 500 ETF (SPY), an exchange-traded fund (ETF) that tracks the S&P 500 Index, and the Invesco QQQ Trust (QQQ) jumped 13% and 15%, respectively, for the year.

Sentiment toward the SPY and QQQ ETFs was ‘bullish’ by early Monday, while the message volume stayed at ‘normal’ levels.

The CME FedWatch Tool, which predicts rate moves based on expectations of futures traders, puts the odds of a 25 basis-point cut in September at 94.2%. The odds of a 50 basis-point cut are at a much smaller 5.8%.

In a post on X, a prominent trader and trade advisor said, “$SPX implied move has expanded to 94 points into triple witching week. With the FOMC in focus, a rate cut is fully priced — attention shifts to the forward path, which has swung dovish on weakening employment data.

“Sell-the-news on cut potential.”

On the other hand, economist Peter Schiff is opposed to any cut by the central bank. “The Fed is about to make a major policy mistake by cutting interest rates into rising inflation,” he said in a social media post, repeating his view from the past, ever since the hopes of this rate cut began to gain steam.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Contact to : xlf550402@gmail.com

Copyright © boyuanhulian 2020 - 2023. All Right Reserved.